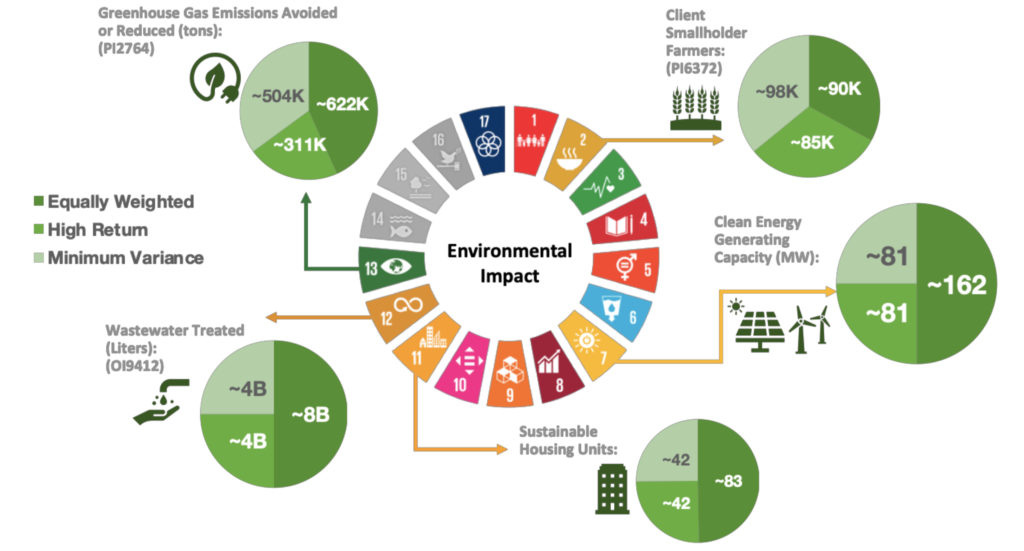

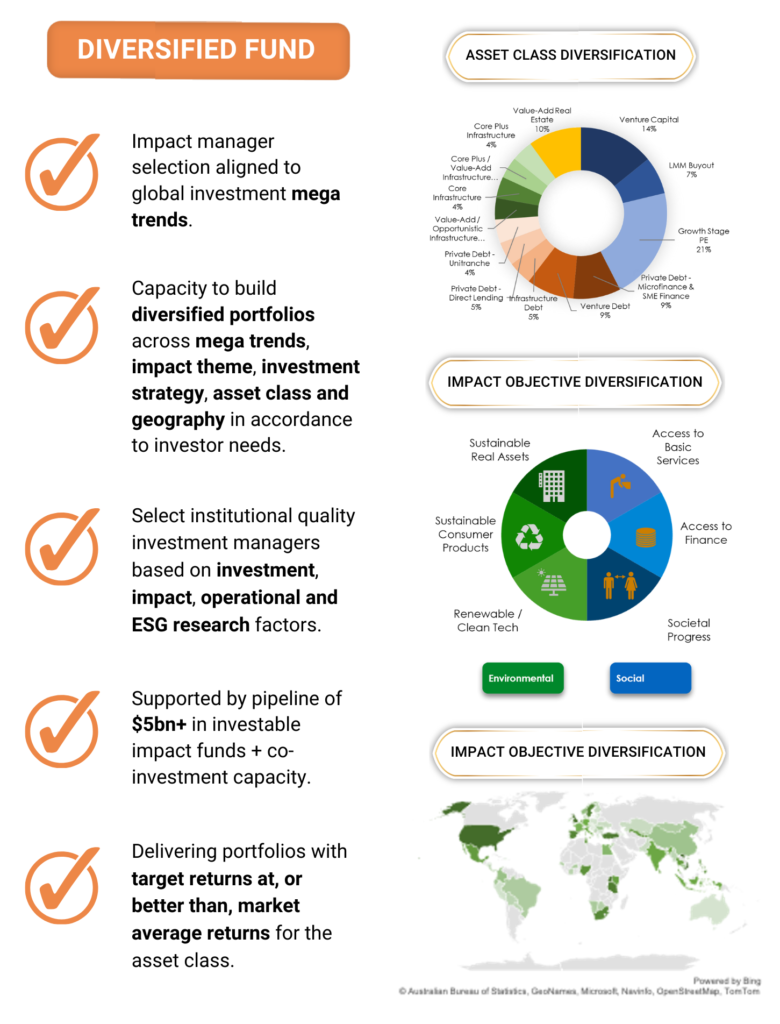

WON-IAM seizes impact investment opportunities driven by global megatrends such as climate transition (MegaT1), diversity, equity, and inclusion (MegaT2), and transformative technologies (MegaT3). We create multi-asset, multi-manager, portfolios that maximize client returns while delivering significant positive social and environmental impact for a given level of risk. By analysing historical risk, return, and impact data, and incorporating future targeted returns and impact outcomes, as well as investor-specific preferences for risk, return, and impact, we determine the optimal portfolio mix, ensuring maximum exposure and diversification across MegaT1, MegaT2, and MegaT3.

Our firm belief, supported by in-depth research, is that the optimal way to leverage and benefit from the emerging global investment megatrends is through impact investment opportunities in private markets due to the long-term nature of the holdings and the significant ownership stakes in equity strategies.

Globally, we continue to identify compelling impact investment opportunities within Private Credit, Fixed Income, Private Equity, Venture Capital, Real Estate, and Infrastructure. In Australia, we see promising smaller-scale opportunities in Infrastructure, Private Credit, and Private Equity, with substantial opportunities in Real Estate, particularly in social housing.