DISCLAIMER: Case studies are indicative and do not represent unit trusts or other investible funds. Portfolios are bespoke and created for institutional wholesale clients. Fund returns are annualised, are calculated using performance data received from third party sources which may not be audited. Returns are net of underlying management fees but before deduction of fees by Wealth of Nations Impact Asset Management and others. Returns are pre-tax, and assume the reinvestment of any distributions. The investment returns shown are historical and no warranty can be given for future performance. Historical performance is not a reliable indicator of future performance. Source: Wealth of Nations Impact Asset Management Limited.

Case study 1 | Government Fund

Reasons to allocate

DIVERSIFIED EXPOSURE

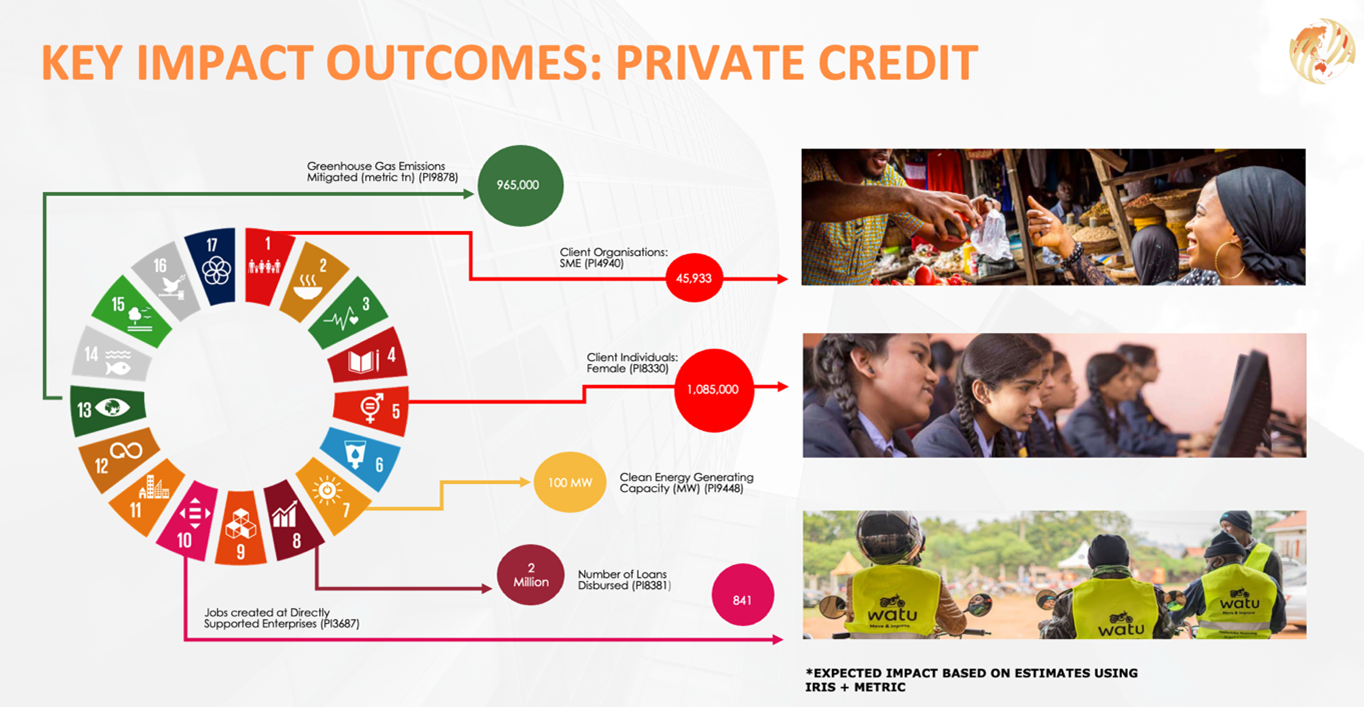

Offers a broad range of private debt opportunities, including niche areas like microfinance and SME finance.

IMPACT FOCUS

Aligns with global sustainability goals, providing measurable social and environmental benefits.

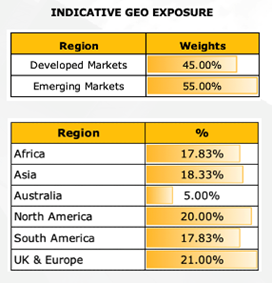

The portfolio has a global investment mandate, with measurable contribution to both environmental and social outcomes throughout all invested countries. To reduce concentration risk, the portfolio construction limits single country exposure.

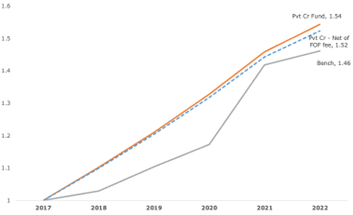

COMPETITIVE RETURNS

The strategy aims for competitive returns through diversified private debt investments, focusing on high-yield opportunities in both developed and emerging markets. It emphasises maximising alpha by carefully selecting investments that offer robust returns while minimizing the risk of default.

Portfolio Outcomes

Portfolio Benchmark

Investor Benchmark

50% Bloomberg AusBond Bank Bill Index + 3% p.a.

25% S&P/LSTA Leveraged Loan Index (AUD Hedged)

12.5% HFRI ED – Distressed/Restructuring Index (AUD Hedged)

12.5% Merrill Lynch High Yield Master II (AUD Hedged)