DISCLAIMER: Case studies are indicative and do not represent unit trusts or other investible funds. Portfolios are bespoke and created for institutional wholesale clients. Fund returns are annualised, are calculated using performance data received from third party sources which may not be audited. Returns are net of underlying management fees but before deduction of fees by Wealth of Nations Impact Asset Management and others. Returns are pre-tax, and assume the reinvestment of any distributions. The investment returns shown are historical and no warranty can be given for future performance. Historical performance is not a reliable indicator of future performance. Source: Wealth of Nations Impact Asset Management Limited.

Case study 5 | Model Portfolio – Diversified Impact Fund

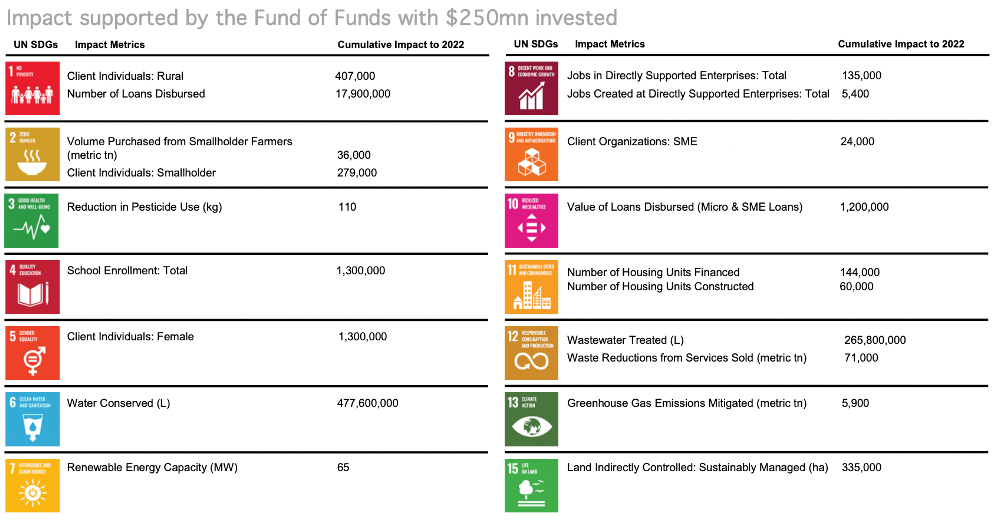

DRIVING MAXIMUM IMPACT ACROSS UNSDG'S

Reasons to allocate

MULTI ASSET CLASS AND IMPACT THEMES

The Diversified Impact Fund is a theoretical model portfolio that aims to have a mix of social and environmental impact across its spectrum of investments that diversify across the UN SDG goals, within Private Equity, Private Debt, Reals Assets, Infrastructure and Fixed Income.

GLOBAL OPPORTUNITY

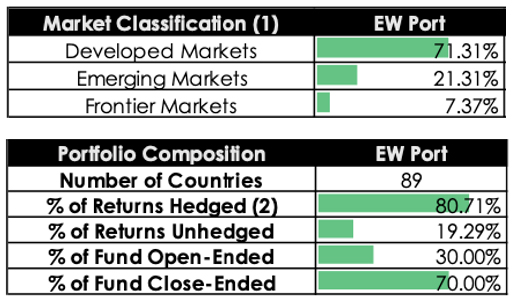

The fund aims to deliver global as well as local environmental outcomes and contribute to social development in the target countries. To reduce single country/region risk exposure we have ensured that manager impact investments are geographically diversified

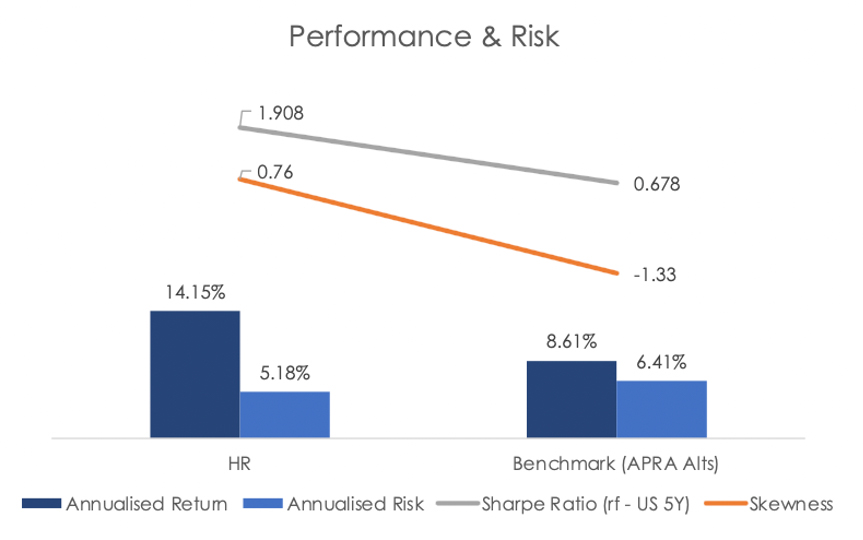

COMPETITIVE RETURN

The fund comprises of high-quality impact managers that are expected to deliver risk-adjusted market or market+ returns.

IMPACT WASHING

Our intention to deliver true-to-label impact is made possible through the

core principles of impact investing, intentionality, measurability, and contribution. Impact diligence first starts from the alignment of each manager intentionality through the alignment objectives and outcomes to the Sustainable Development Goals and the underlying targets, impact is measured utilising industry leading IRIS+ and IMP 5 Dimensions of Impact frameworks and contribution is assessed through their alignment with the Operating Principles of Impact Management.

core principles of impact investing, intentionality, measurability, and contribution. Impact diligence first starts from the alignment of each manager intentionality through the alignment objectives and outcomes to the Sustainable Development Goals and the underlying targets, impact is measured utilising industry leading IRIS+ and IMP 5 Dimensions of Impact frameworks and contribution is assessed through their alignment with the Operating Principles of Impact Management.

Portfolio Outcomes

Portfolio Benchmark

APRA - Growth Alternatives

37.50% MSCI All Country World Ex-Aus Equities Index with Special Tax (100% hedged to AUD).

37.50% MSCI All Country World Ex-Aus Equities Index with Special Tax (unhedged in AUD).

25% Bloomberg Barclays Global Aggregate Index (hedged in AUD).