DISCLAIMER: Case studies are indicative and do not represent unit trusts or other investible funds. Portfolios are bespoke and created for institutional wholesale clients. Fund returns are annualised, are calculated using performance data received from third party sources which may not be audited. Returns are net of underlying management fees but before deduction of fees by Wealth of Nations Impact Asset Management and others. Returns are pre-tax, and assume the reinvestment of any distributions. The investment returns shown are historical and no warranty can be given for future performance. Historical performance is not a reliable indicator of future performance. Source: Wealth of Nations Impact Asset Management Limited.

Case study 4 | Asset Management Firm

Reasons to allocate

MULTI ASSET CLASS AND IMPACT THEMES

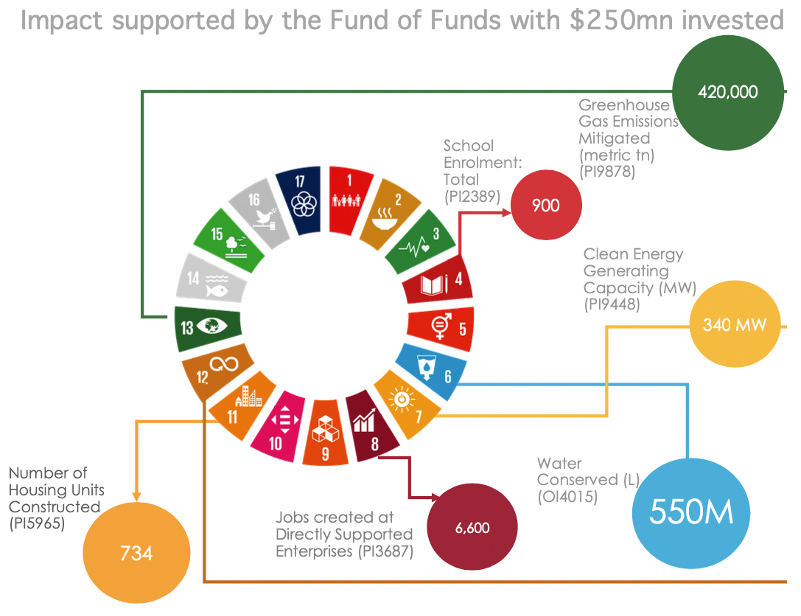

The Fund aims to have a mix of social and environmental impact across its spectrum of investments that diversify across Private Equity, Private Debt, Reals Assets and Infrastructure. The climate theme and developed market focus mandate focuses our investable universe into fund and managers into SDG 7 (Affordable and Clean Energy), SDG 12 (Responsible Consumption and Production) and SDG 13 (Climate Action).

DEVELOPED MARKET FOCUS

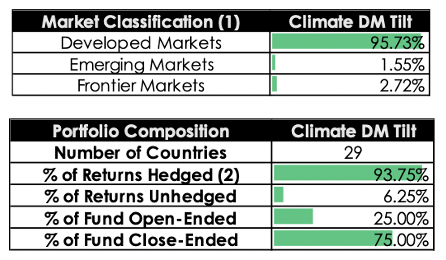

In line with the client’s request for proposal, the portfolio was designed to be invest across developed markets.

COMPETITIVE RETURN

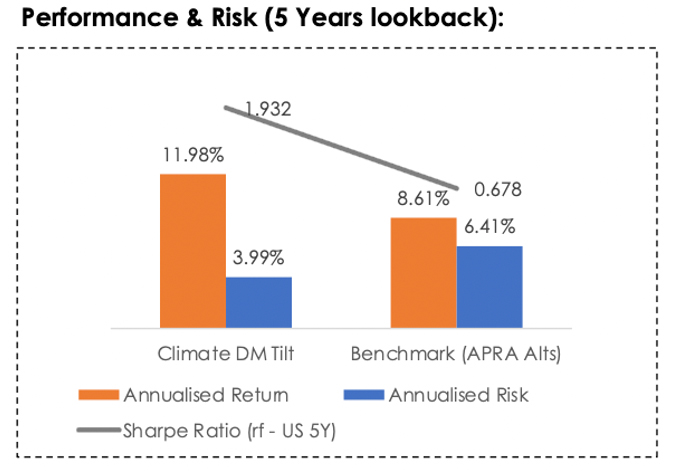

Our manager selection process resulted in the selection of high-quality impact funds that have delivered risk-adjusted returns. Our portfolio design incorporates both lower risk infrastructure assets providing return stability with contribution to the energy transition and growth equity investments seeking to deliver significant returns upside while delivering climate adaption solutions. Our back-tested portfolio outperforms the APRA Alts Benchmark (50% Public Equity, 50% Public Debt) across the 5-year lookback period.

AVOIDANCE OF IMPACT WASHING

Our intention to deliver true-to-label impact is made possible through the core principles of impact investing, intentionality, measurability, and contribution. Impact diligence first starts from the alignment of each manager intentionality through the alignment objectives and outcomes to the Sustainable Development Goals and the underlying targets, impact is measured utilising industry leading IRIS+ and IMP 5 Dimensions of Impact frameworks and contribution is assessed through their alignment with the Operating Principles of Impact Management.

Portfolio Outcomes

Portfolio Benchmark

APRA - Growth Alternatives

37.50% MSCI All Country World Ex-Aus Equities Index with Special Tax (100% hedged to AUD).

37.50% MSCI All Country World Ex-Aus Equities Index with Special Tax (unhedged in AUD).

25% Bloomberg Barclays Global Aggregate Index (hedged in AUD).