DISCLAIMER: Case studies are indicative and do not represent unit trusts or other investible funds. Portfolios are bespoke and created for institutional wholesale clients. Fund returns are annualised, are calculated using performance data received from third party sources which may not be audited. Returns are net of underlying management fees but before deduction of fees by Wealth of Nations Impact Asset Management and others. Returns are pre-tax, and assume the reinvestment of any distributions. The investment returns shown are historical and no warranty can be given for future performance. Historical performance is not a reliable indicator of future performance. Source: Wealth of Nations Impact Asset Management Limited.

Case study 2 | Industry Super Fund

Reasons to allocate

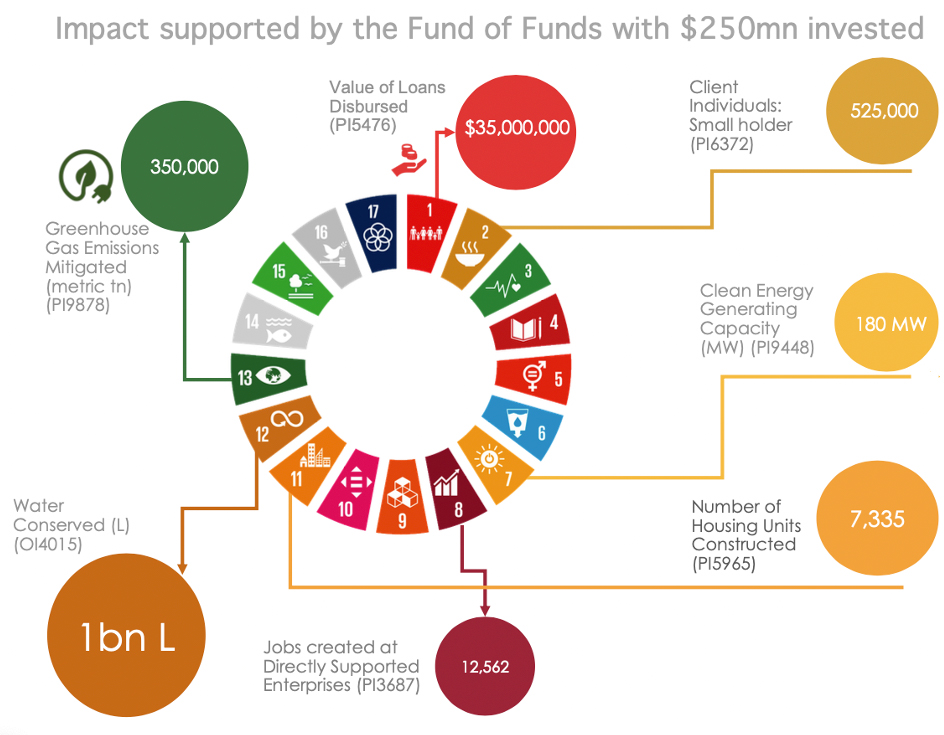

MULTI ASSET CLASS AND IMPACT THEMES

The Fund aims to have a mix of social and environmental impact across its spectrum of investments that diversify across the UNSDGs, within Private Equity, Private Debt, Reals Assets, Infrastructure and Fixed Income.

GLOBAL OPPORTUNITY

The Fund aims to deliver global as well as local environmental outcomes and contribute to social development in the target countries. To reduce single country/region risk exposure we have ensured that manager impact investments are geographically diversified.

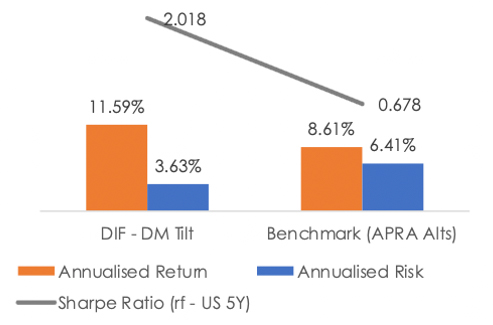

COMPETITIVE RETURN

The fund comprises of high-quality impact managers that are expected to deliver risk-adjusted market or market+ returns.

AVOIDANCE OF IMPACT WASHING

The fund utilises external third-party impact verification; utilises IRIS+ and IMP Impact Measurement Framework; promotes the Operating Principles of Impact Management.

Portfolio Outcomes

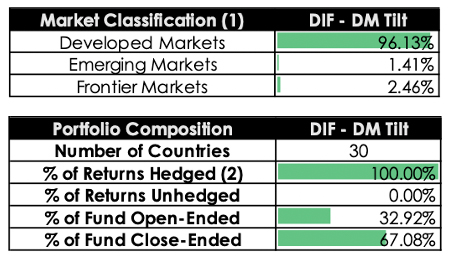

Portfolio Benchmark

APRA - Growth Alternatives

37.50% MSCI All Country World Ex-Aus Equities Index with Special Tax (100% hedged to AUD).

37.50% MSCI All Country World Ex-Aus Equities Index with Special Tax (unhedged in AUD).

25% Bloomberg Barclays Global Aggregate Index (hedged in AUD).