The Definitions and Differences

Many people and companies believe that if one is to be conscious of the environmental and social implications of their investments or screen out any negative effects and put in place some level of basic governance to their capital investments that they are Impact Investors. This customary view does not level up to what “Impact Investing” really is.

The GIIN (Global impact Investing Network) defines impact investing as “investments with the intention to generate positive, measurable social and environmental impacts alongside a financial return”[1]. The key factor in this definition is the INTENTION of the Investor or Enterprise that wishes to part with their capital, as they intend to advance a positive ethical outcome alongside a favourable financial return.

In the case of ESG, Investopedia defines this area as an “environmental, social and governance practice of an investment, that may have material impact on the performance of that venture”[2]. Although this shows a social and environmental conscience, the main objective of ESG valuation pertains to the investment’s financial performance. Therefore, this adherence to ESG is mostly a risk mitigating factor for practical purposes beyond an ethical concern, since many organisations wish to follow ESG criteria for brand promotion, to avoid negative PR and/or to signal their companies that they could be at risk similar to the VW emission scandal or the 2010 BP oil spill debacle that plummeted the company’s stock prices and resulted in billion-dollar payouts and negative public relations[3]. In short ESG is driven by a commercial opportunity over an intentional positive outcome to society and the environment.

Another factor to note is that ‘Socially Responsible Investing’ (SRI), which is similar to ESG, yet goes one step further by actively eliminating or selecting investments that follow certain ethical guidelines. For example, SRI’s will seek to avoid investing in companies that deal with alcohol, tobacco, firearms production, human rights and labour violations and environmental damages etc[4]. SRI still values profit but it seeks to balance its yield against its core principles, i.e., to generate return without violating one’s social conscience[5].

Why Impact Investing?

Impact investing allows an investor, whether it be a Fund Manager, an Individual Investor, a Pension Fund, Religious Institution, an Insurance Company, a DFI or Bank to provide capital to address the world’s most pressing challenges in the world. Whether it be equality, sustainable agriculture, renewable energy, conservation, micro finance, climate impacts and/or accessibility to basic services such as housing, healthcare, education and food for all people.

Impact investing is not a welfare scheme or charity. Many impact enterprises and investors seek to intentionally invest in projects or research that will provide a future positive social and environmental impact (more so under 1 or more of the 17 stated UNSDG’s)[6], they also expect to generate a financial return on capital at market value, with a few exceptions at concessionary return in the short term.

We as individuals and team members in organisations each have the ability to positively change the trajectory our forefathers deteriorated over decades of industrialisation and over consumption. The opportunity to be a part of the future solution, one that is no longer decades away, but a present circumstance and action that falls upon our shoulders to push forward so our children and the future generations can enjoy the pleasures of natural beauty, humanity and kindness to all things around us that we were lucky to experience and have a glimpse of when we were young.

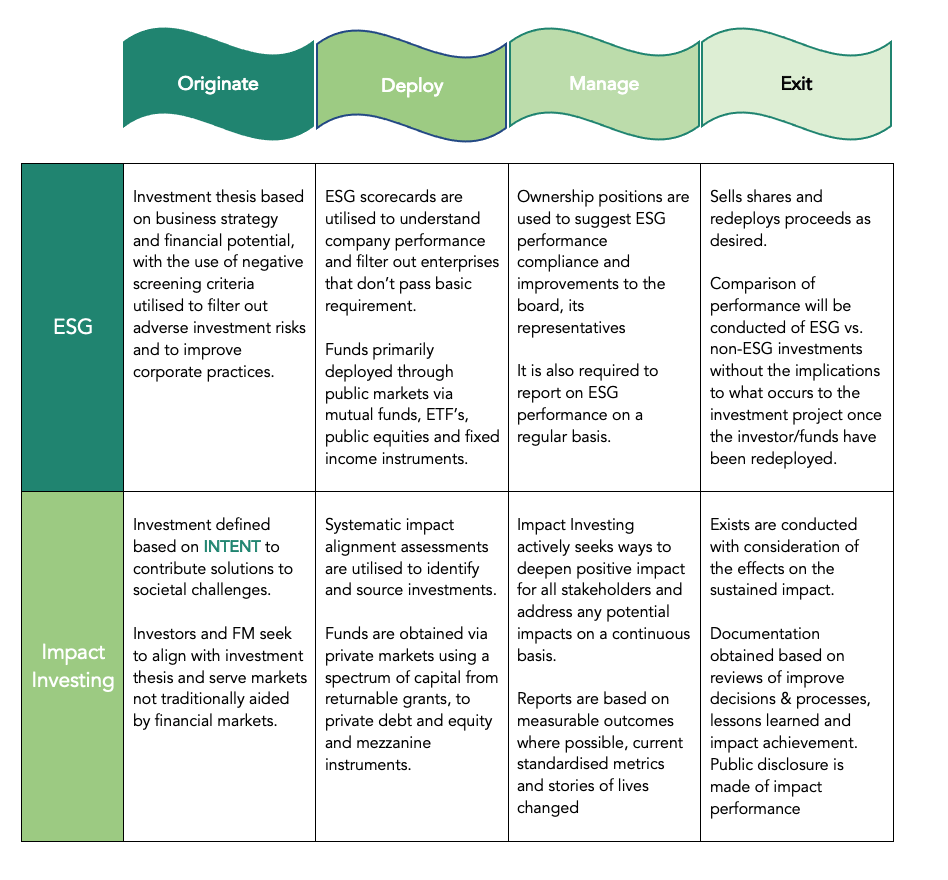

Comparison of ESG versus Impact Investing in a typical investment process

Gaining greater clarity in the difference of Impact Investing over ESG can be determined by the actions taken at each stage of a typical investment process. The 4 key stages are: Originate, Deployment of capital, Managing the investment project and Exit[7].

Measuring Impact

In the past many of the concerns in ‘Impact Investing’ has been due to the lack of standardised measurements. Yet with improved and more robust screening tools being developed over the past couple of years such as IRIS+ (under GIIN), IFC’s Environment and Performance Standards, Operating Principles for Impact Management (with good guidance on responsible exits), UN Principles of Responsible Investments (PRI), Sustainable Accounting Standard Board, Alinus SPI4 etc. greater ability and capacity is being presented frequently to assist in validating the returns and positive impact that these investments are bringing not only to the investor but to the overall community and planet.

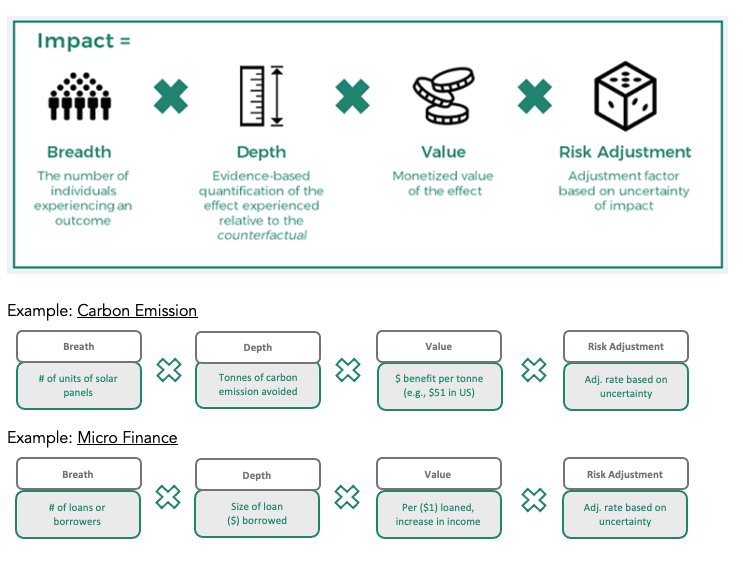

Although many questions may exist in these screening processes and they may vary according to the asset class or industry the measurement pertains too, one of the key questions asked by many is how an enterprise/investor can monetise impact?

Y Analytics provides a simplified measure to assess impact and help organisations define impact by incorporating 4 metrics[8].

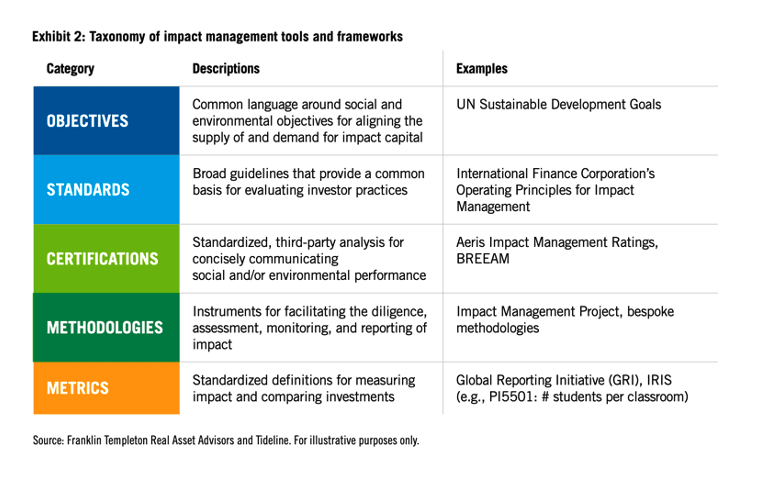

Although no unified best practice has emerged for impact investing as yet, the pace at which impact investing is gaining traction gives hope that more refined, streamlined methodologies will emerge in the near future. Until that time, multiple frameworks are used in combination (on average a combination of three tools, frameworks, standards and rating systems[9]), along with some customised elements to fit an investor’s strategy[10].

To understand these frameworks and their roles in impact management, Franklin Templeton and Tideline classified the frameworks into five broad categories.

Ultimately each investor must decide on a combination and level of customisation required for proper impact management system. As this is an emerging area, a dynamic process is required to continuously improve and capture all impact variables.

That is why here at #WoNA, we make it our mission to assist each investor find the right IMPACT Fund Manager that sets a combination of realistic, evidence-based targets for what our investments can achieve, that value the importance of monitoring and evaluating actual achievements using appropriate data to ascertain whether the investment made provides material positive changes to society and the environment and avoids harm along the way.

Therefor in summary, despite the commonalities in ESG and Impact Investing and the fact that many advisors lump these two areas together into an umbrella term such as ‘sustainable investments’, there are 3 important distinctions that can help investors ensure their investment are impact investments. They are,

- Select assets with the INTENT of impact,

- Contribution to the impact of the INVESTEE FIRM,

- OBJECTIVE MEASUREMENT of the impact investment.

[1] GIIN – What you need to know about Impact Investing – (https://thegiin.org/impact-investing/need-to-know/) accessed on 9th April 2021

[2] Investopedia – ESG, SRI and Impact Investing: What’s the Difference – (https://www.investopedia.com/financial-advisor/esg-sri-impact-investing-explaining-difference-clients/) accessed 7th April 2021

[3] Investopedia – ESG Criteria – (https://www.investopedia.com/terms/e/environmental-social-and-governance-esg-criteria.asp) accessed 11th April 2021

[4] [Same as ref. 2 above]

[5] SRI – (https://www.investopedia.com/financial-advisor/esg-sri-impact-investing-explaining-difference-clients/) accessed on 7th April 2021

[6] UN Sustainable Development Goals – (https://sdgs.un.org/goals) accessed 12th April 2021

[7] IFC – The difference between ESG and Impact Investing and why it matters (https://ifc-org.medium.com/the-difference-between-esg-and-impact-investing-and-why-it-matters-8bf459b3ccb6)

[8] Evidence based Impact, Y analytics (https://yanalytics.org/research-insights/evidence-based-impact ) assessed 15th April 2021

[9] GIIN: The state of impact Measurement and Management Practice, December 2017 – accessed 15th April 2021

[10] Franklin Templeton: Five Building Blocks for Impact Management – (https://www.ftinstitutionalemea.com/content-common/topic-paper/en_GB/five-building-blocks-for-impact-management-tideline-0319.pdf) assessed 12th April 2021

Image Credits: Markus Spiske from Pexel