DISCLAIMER: Case studies are indicative and do not represent unit trusts or other investible funds. Portfolios are bespoke and created for institutional wholesale clients. Fund returns are annualised, are calculated using performance data received from third party sources which may not be audited. Returns are net of underlying management fees but before deduction of fees by Wealth of Nations Impact Asset Management and others. Returns are pre-tax, and assume the reinvestment of any distributions. The investment returns shown are historical and no warranty can be given for future performance. Historical performance is not a reliable indicator of future performance. Source: Wealth of Nations Impact Asset Management Limited.

Case Study 6 | Climate Transition – Private Equity Portfolio

DRIVING MAXIMUM IMPACT ACROSS UNSDG'S

Reasons to allocate

DIVERSIFIED PRIVATE EQUITY EXPOSURE AND IMPACT THEMES

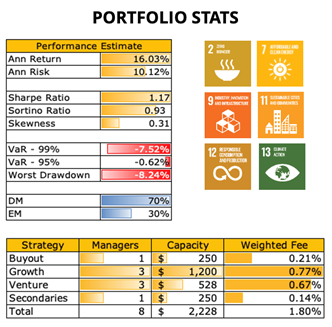

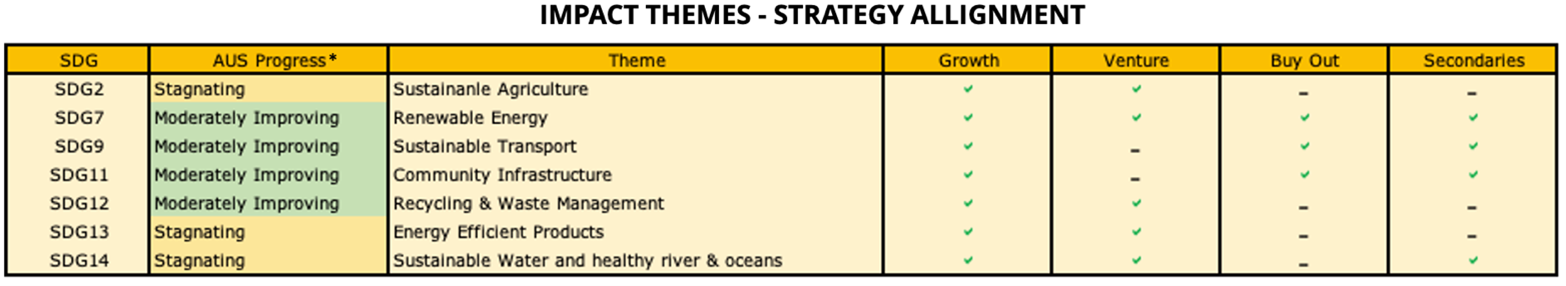

This strategy provides diversified exposure within private equity, including growth, venture, buyout, and secondaries sub-strategies, this diversification allows investors to engage with companies at various stages of development.

MEGATRENDS

It is strategically aligned with themes such as climate transition, diversity, equity & inclusion, and transformative technologies. This multi-faceted approach allows investors to benefit from various sectors and innovations, enhancing the overall resilience and potential of the portfolio.

GLOBAL OPPORTUNITY

The strategy taps into global opportunities offering investors access to international markets and emerging opportunities. This global perspective not only spreads investment risk across different geographies but also positions the portfolio to capitalise on inaccessible growth areas.

COMPETITIVE RETURNS

By focusing on sectors poised for long-term growth and innovation, the strategy aims to deliver competitive financial returns. Investments in cutting-edge technologies and sustainable practices are designed to drive profitability and value creation, aligning financial performance with future-oriented trends.

Portfolio Outcomes

Portfolio Benchmark

APRA - Growth Alternatives

37.50% MSCI All Country World Ex-Aus Equities Index with Special Tax (100% hedged to AUD).

37.50% MSCI All Country World Ex-Aus Equities Index with Special Tax (unhedged in AUD).

25% Bloomberg Barclays Global Aggregate Index (hedged in AUD).